Consumer and cultural trends influenced by the war

Gradus Research presented an updated portrait of the Ukrainian consumer and cultural trends for 2025 at the 18th Ukrainian Marketing Forum. The focus was on long-term stress adaptation, new purchasing behavior models, and shifting life priorities.

Self-care as a survival strategy

High and prolonged stress — persistently hovering around 90% — has pushed Ukrainians to invest more time in their health. 52% of respondents noted that self-care requires more effort than before. At the same time, 39% admitted feeling emotionally burned out.

Price over brand

Amid economic challenges, Ukrainians are increasingly guided by product prices. 64% of consumers choose cheaper brands, while only 25% opt for more expensive ones. Notably, younger generations — Gen Z and Millennials — are gradually showing a willingness to spend more on premium products.

“We are witnessing a deep reevaluation of values across all areas of life—from everyday expenses to big dreams. The war has shaped a new type of Ukrainian: flexible, attentive to themselves and loved ones, and critical in their choices,” commented Evgeniya Blyznyuk, sociologist, CEO and founder of Gradus Research.

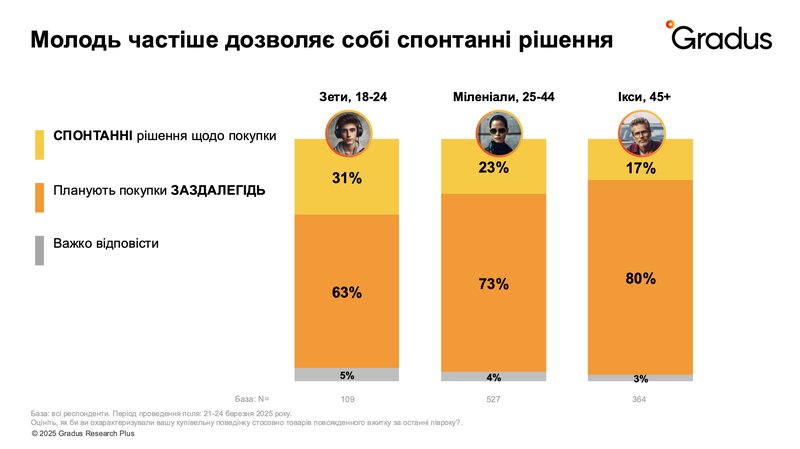

The return of spontaneity

After a long period of cautious planning, consumers are rediscovering spontaneous purchases. In 2025, the share of impulse shoppers grew to 21%, with an even higher rate among the youth.

Shift toward basic needs and emotional resources

Spending patterns have also changed. Ukrainians increased expenditures on food, medicine, and utilities, while cutting back mostly on entertainment and household appliances. At the same time, festive moments — birthdays, Easter, and other family events — have become an important emotional resource, restoring a sense of normalcy.

The full research report is available commercially upon request at: dn@gradus.app

Report structure:

🟠 Changing attitudes toward brands since the beginning of the war — importance of brand in purchase decisions (in dynamics: Dec 2022, Mar 2024, Mar 2025; by age; by region and settlement size)

🟠 Changes in purchasing behavior — buying familiar vs. new brands (in dynamics: Dec 2022, Mar 2024, Mar 2025; by age; by settlement size)

🟠 Reasons for starting to buy new brands (in dynamics: Dec 2022, Mar 2024, Mar 2025; by gender and age)

🟠 Reasons for continuing to buy familiar brands (in dynamics: Dec 2022, Mar 2024, Mar 2025; by gender and age; by region)

🟠 Behavior shifts in everyday product categories — switching to cheaper vs. more expensive brands (in dynamics: Dec 2022, Mar 2024, Mar 2025; by age, region, and settlement size)

🟠 Refusing to buy favorite brands vs. continuing to buy them (in dynamics: Dec 2022, Mar 2024, Mar 2025; by gender and settlement size; by region)

🟠 Preferences for foreign/international vs. Ukrainian brands (in dynamics: Dec 2022, Mar 2024, Mar 2025; by gender and age; by settlement size)

🟠 Spontaneous vs. planned purchases (in dynamics: Dec 2022, Mar 2024, Mar 2025; by age)

🟠 Buying in convenient nearby locations vs. favorite places (in dynamics: Dec 2022, Mar 2024, Mar 2025)

🟠 Shopping in supermarkets/stores vs. markets (in dynamics: Dec 2022, Mar 2024, Mar 2025; by region and settlement size)

🟠 Online vs. offline shopping (in dynamics: Mar 2024, Mar 2025)

🟠 Product/service categories where consumers are cutting spending (in dynamics: Mar 2024, Mar 2025; by gender and age; by region and settlement size)

🟠 Saving strategies when buying everyday goods (in dynamics: Mar 2024, Mar 2025; by gender and age; by region)

🟠 Consumption patterns: use of mobile apps and online services (in dynamics: Mar 2024, Mar 2025; by gender and age; by region and settlement size)

🟠 Consumption patterns: environmentally conscious consumption (in dynamics: Mar 2024, Mar 2025; by gender; by region; by settlement size)

The research was conducted by Gradus Research via self-administered surveys in the Gradus mobile app. The sample reflects the population structure of Ukrainian cities with over 50,000 residents aged 18–60, by gender, age, settlement size, and region, excluding temporarily occupied territories and active combat zones. Fieldwork period: March 21–24, 2025. Sample size: 1,000 respondents.

Other reports

-

34th Anniversary of Independence: How Do Citizens See Ukraine?August 2025Special survey for the Independence Day 2025

34th Anniversary of Independence: How Do Citizens See Ukraine?August 2025Special survey for the Independence Day 2025 -

Ukrainians' expectations from the meeting between Trump and putin in AlaskaAugust 2025Urgent poll on Ukrainians' expectations from the meeting between Trump and Putin

Ukrainians' expectations from the meeting between Trump and putin in AlaskaAugust 2025Urgent poll on Ukrainians' expectations from the meeting between Trump and Putin -

Return or Stay? How Ukrainian Migrants’ Sentiments in the EU Are ChangingAugust 2025Second wave of migration research for URC 2025

Return or Stay? How Ukrainian Migrants’ Sentiments in the EU Are ChangingAugust 2025Second wave of migration research for URC 2025 -

69% of surveyed Ukrainians support the protestsJuly 202569% of Ukrainians support the protests, and two-thirds of respondents believe they will lead to real change

69% of surveyed Ukrainians support the protestsJuly 202569% of Ukrainians support the protests, and two-thirds of respondents believe they will lead to real change